The Polish e-commerce market in 2025 remains one of the most significant areas of the digital economy. Online shopping has become an everyday habit for most internet users, which is clearly reflected in the available data.

How many Poles shop online?

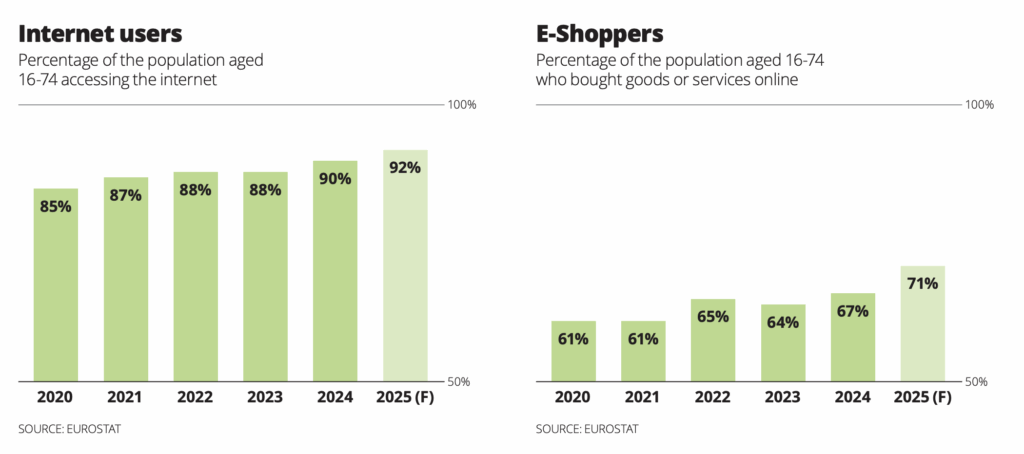

There are approximately 30 million internet users in Poland, representing 92% of the population aged 16–74. Importantly, 71% of these users shop online. This confirms that e-commerce is a well-established and widely adopted purchasing model among Polish consumers.

What motivates consumers to shop online more often?

Price-related factors have the greatest influence on purchasing decisions. When asked, “What would encourage you to shop online more frequently?”, respondents indicated:

- 47% — lower delivery costs,

- 46% — lower prices compared to brick-and-mortar stores,

- 43% — discount codes.

Fast delivery is also an important factor, as consumers increasingly expect convenience and quick order fulfilment.

Mobile shopping: an important part of the customer journey

Mobile devices play a key role in the online shopping experience. As many as 65% of smartphone and tablet users make purchases using their mobile devices. This shows that mobile is an essential touchpoint in the shopping journey — both for browsing and finalising transactions.

Which search engines do Polish consumers use?

Google remains the dominant search engine, although usage varies slightly by device:

- 95% of mobile searches are made through Google,

- On desktop: 84% Google, and over 11% Bing.

This confirms that Google is the primary tool used by consumers to discover and compare products online.

Preferred delivery methods

Delivery method is a major factor affecting purchasing decisions. The most popular options among Polish consumers are:

- 86% — parcel lockers,

- 56% — courier delivery to home or workplace,

- 38% — partner pickup points (e.g., Żabka, Orlen).

When it comes to parcel lockers specifically, one provider stands out:

- 87% most frequently use InPost lockers,

- The remaining 10% is split between Allegro, Orlen, DPD, and DHL lockers.

This shows that parcel lockers have become a standard expectation within the Polish online shopping experience.

The most popular payment methods in Poland

Polish consumers strongly prefer fast and convenient payment solutions. The breakdown is as follows:

- 56% — BLIK,

- 20% — fast bank transfers (Pay-By-Link / Fast Transfer, such as Przelewy24, PayU, T-Pay etc.),

- 11% — card payments,

- 4% — cash on delivery.

BLIK remains the leading payment method, significantly influencing the speed and simplicity of checkout.

Summary

The e-commerce landscape in Poland in 2025 is stable, mature, and shaped by clear consumer expectations. Shoppers:

- regularly make online purchases,

- focus on price and delivery costs,

- expect quick and convenient delivery options,

- prefer BLIK and other instant payments,

- use Google as the main starting point for product searches.

These insights outline the key directions for online stores operating in Poland — transparency, competitive pricing, strong logistics options, and mobile-friendly purchasing experiences are essential for maintaining competitiveness in the coming years.

Sources:

- European E-commerce Report 2025, Ecommerce Europe, https://ecommerce-europe.eu/wp-content/uploads/2025/10/CMI2025_LIGHT_CORRIGENDUM.pdf

- Omni-commerce. Buying comfortably 2025, Izba Gospodarki Elektronicznej, https://eizba.pl/wp-content/uploads/2025/07/Omni-commerce-Buying-comfortably-2025-abstract.pdf

- E-commerce w Polsce 2025, Gemius, https://gemius.com/documents/81/RAPORT_E-COMMERCE_2025.pdf